Non-public fairness companies invested just about $70 billion in the existence sciences and health care product industries past year — a sign that the pandemic’s disruptions failed to awesome desire in the sectors, in accordance to a new report by the American Investment Council.

Why it matters: The inflow of money could enable bring a lot more lifesaving prescription drugs and medical technologies to market place. But personal equity’s escalating existence in overall health treatment just isn’t normally considered positively, particularly when it truly is linked with price improves or lessened accessibility to care.

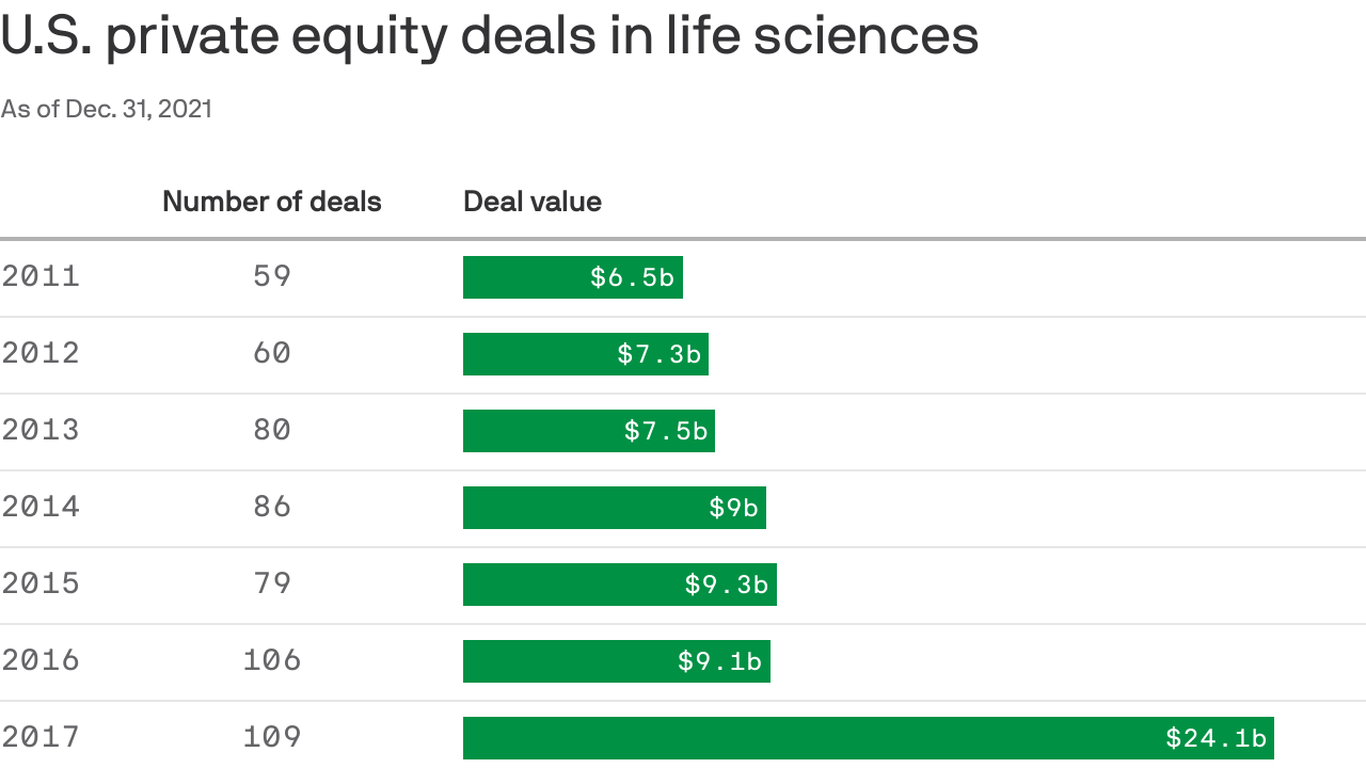

By the figures: Personal equity deals in the life sciences sector have been truly worth almost $26 billion in 2021, the greatest total in a ten years.

- Professional medical equipment and supplies deals have been truly worth approximately $44 billion very last 12 months, which was also the maximum value above the previous ten years — by significantly.

- Non-public fairness has invested a lot more than $280 billion into the sectors over the previous 10 years, according to the report.

What they are saying: “What COVID introduced was probably a even larger concentrate on well being care gaps and requires in the region, and I assume you observed a lot more money going into this sector as a consequence of a new concentrate on exposing some of the challenges we have in the overall health treatment procedure,” American Expenditure Council CEO Drew Maloney stated in an job interview.

- “We really are filling a hole in the market to provide these innovations to existence through our funding mechanisms,” he extra.

The major image: Private equity companies like Bain Cash, Cerberus and Blackstone Group already have invested seriously in hospitals, nursing homes and staffing companies — which not everybody thinks is a very good matter. The companies normally depend on credit card debt financing to get property, increase returns to associates and exit in a relatively short window of time.

- The existence arrived into engage in through Washington’s shock billing discussion, which concentrated partially on the habits of non-public fairness-backed medical professional staffing firms. Non-public fairness-owned nursing homes have also been criticized as offering reduce-high-quality treatment.

Of course, but: Investing in drug and device growth isn’t the exact as investing in these other spots, reported Craig Garthwaite, a professor at Northwestern University’s Kellogg Faculty of Management.

- “There is a lot of value to be designed and captured by these personal fairness companies, and you will find considerably fewer of the fret … about personal equity and health and fitness treatment companies or vendors,” Garthwaite said. “In a product market place, we believe of this remaining the domain of for-gain corporations, and we are just arguing about what the cash framework is.”

- And for non-public equity to direct to larger drug rates, pharmaceutical corporations would have to not now be charging the best prices that the market place will bear.

- “I really do not imagine it’ll increase rates right here, simply because I assume people today will cost regardless of what they can for the products, and if they minimize expenses they’re going to just choose it as financial gain,” Garthwaite included.

More Stories

Top 5 Benefits of Seeing a Holistic Chiropractor

A New Smile, A New Life: The World of Dental Implantology

How to Get Rid of Type 1 Diabetes