Table of Contents

As the COVID-19 pandemic has dragged on and considerably of the national wellbeing care dialogue has focused on clinic capacity, health and fitness care employee burnout, COVID-19 vaccination, and other measures to safeguard general public wellness, the superior cost of wellbeing treatment proceeds to be a burden on U.S. families. As KFF polling has found for quite a few many years, health and fitness treatment fees variable into choices about insurance policy coverage and care trying to get, and rank as a leading economical fret. This knowledge note summarizes latest KFF polling on the public’s experiences with health and fitness care expenses. Most important takeaways consist of:

- Many U.S. grown ups have problem affording various well being treatment and dental expenditures. These complications are comparable to – and in lots of conditions greater than – the shares who have problems affording other domestic charges, these types of as lease, transportation, and food items. On top of that, sizeable shares of grown ups older than 65 report problem shelling out for many aspects of health and fitness care, especially products and services not typically lined by Medicare, these as listening to services, dental and prescription drug costs.

- The value of wellbeing care usually helps prevent people today from obtaining needed care or filling prescriptions. Half of U.S. grownups say they set off or skipped some kind of health and fitness treatment or dental treatment in the past 12 months because of the value. Three in 10 (29%) also report not having their medicines as recommended at some place in the past yr since of the charge.

- Superior health care expenditures disproportionately have an impact on uninsured grownups, Black and Hispanic grown ups, and individuals with lessen incomes. Bigger shares of U.S. adults in just about every of these groups report problems affording numerous sorts of care and delaying or forgoing healthcare care because of to the price.

- However, all those who are covered by health and fitness insurance coverage are not immune to the burden of health care charges. Practically fifty percent (46%) of insured adults report issues affording their out-of-pocket fees, and one particular in 4 (27%) report issues affording their deductible.

- Issue paying health care expenses can have considerable consequences for U.S. people. In March 2019, about 1-fourth of U.S. grownups (26%) claimed that they or a family member have experienced complications having to pay professional medical expenditures in the past 12 months, and about fifty percent of this group (12% of all grownups) reported the bills experienced a big influence on their household. Clinical bill problems also disproportionately affect those without well being insurance plan, all those with lessen household incomes, and grown ups in homes where by they or a member of their domestic has a really serious well being problem.

Trouble Affording Clinical Prices

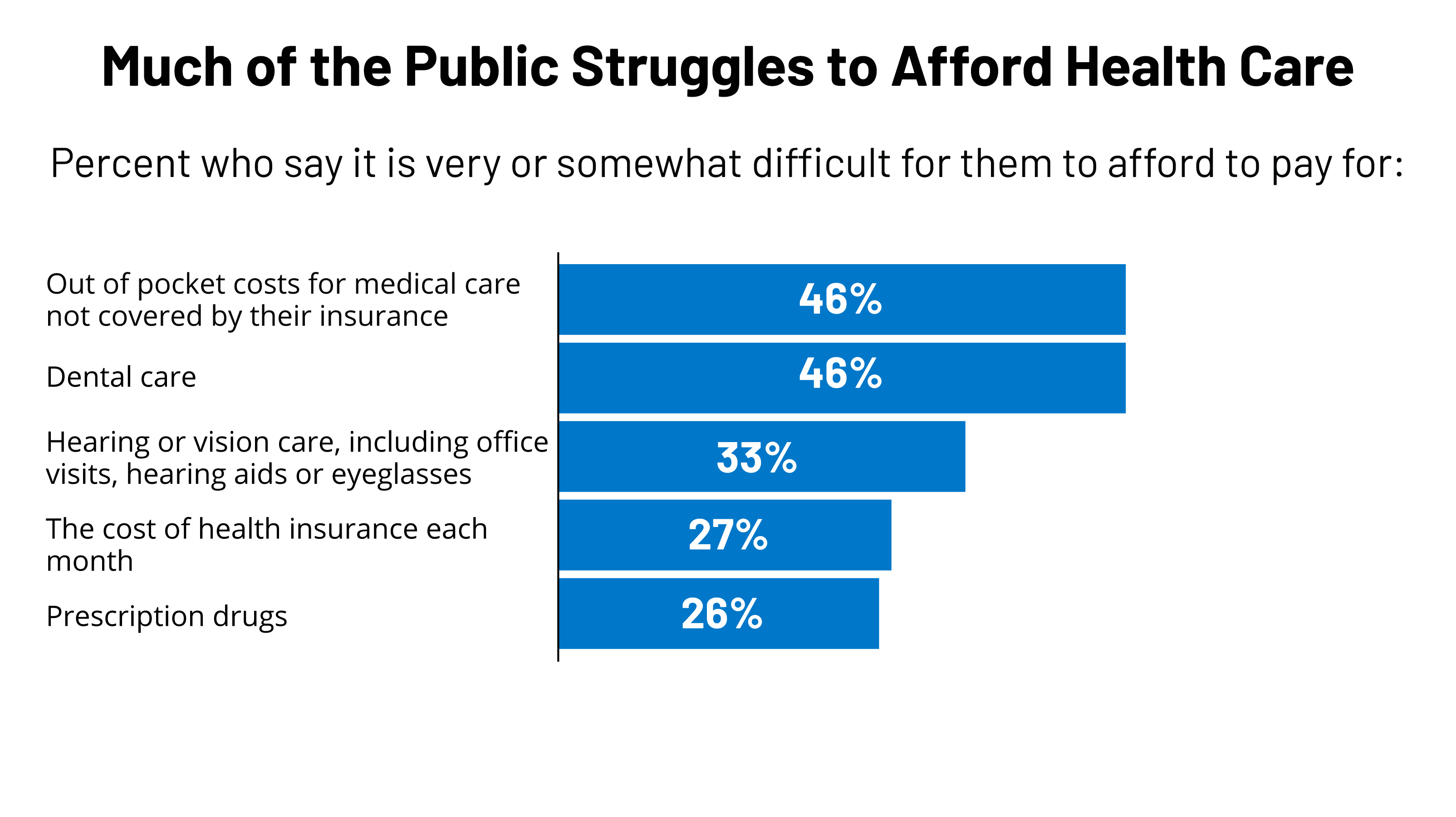

Health treatment expenditures top the record of costs that men and women report trouble affording. Considerable shares of grownups in the U.S. report issues having to pay for various facets of wellness treatment such as just about half who report having difficulty shelling out for dental care (46%) and a related share of insured adults who report issue affording out-of-pocket fees not included by their insurance policies (46%). These shares are substantially higher than the shares who report problem affording other household costs these as rent or home finance loan, gasoline, monthly utilities, or food stuff and groceries. In addition to these expenditures, one-third report tough having to pay for listening to or vision treatment (33%), when about just one-quarter say the exact same about their prescription prescription drugs (26%). Amongst the insured, about a single-quarter (27%) say their every month premium is tricky to afford to pay for. Individuals with decrease incomes, Black and Hispanic adults are far more likely to report problems affording some healthcare expenditures. See Appendix desk A.1 for breaks by socioeconomic and health and fitness standing.

Affording dental, listening to, and vision treatment is also an challenge between grownups 65 and older as individuals added benefits are not normally lined by Medicare. See the Oct 2021 Health and fitness Tracking Poll for a further dive into health treatment expenses and difficulties amid more mature older people.

The price tag of care can also lead some older people to skip or delay trying to find expert services. Fifty percent of adults (51%) report they have delayed or long gone with out sure clinical treatment in the course of the earlier calendar year thanks to price. Dental providers are the most typical variety of medical treatment that folks report delaying or skipping, with 39% of grownups expressing they have set it off in the previous year due to price tag. This is adopted by vision providers (28%), visits to a doctor’s workplaces (24%), mental overall health care (17%), medical center expert services (13%), and listening to aids (9%).

About six in 10 Black and Hispanic grownups (58% just about every) report delaying or skipping at minimum just one sort of health-related care in the earlier calendar year because of to price tag, in comparison to fifty percent (49%) of White adults. Equally, about 6 in ten (63%) older people with residence incomes under $40,000 and 55% of individuals with incomes among $40,000 and $89,999 report delaying some kind of treatment thanks to expense, in contrast to a few in 10 (31%) of individuals in hoseholds creating $90,000 or far more per year. See Apendix desk A.2 for additional breaks by socioeconomic and health and fitness status.

Besides variances by money and race or ethnicity, a KFF report from 2019 identified that folks devoid of overall health insurance were disproportionately possible to place off or skip healthcare treatment or take around-the-counter medications as an alternative of prescription medicine thanks to prices. A few-fourths of older people 18-64 (76%) without overall health insurance documented this, in contrast to 50 % (52%) of grown ups with overall health insurance coverage.

Insurance coverage does not provide ironclad defense, even so. Amid people today with employer-sponsored well being coverage, KFF exploration in 2018 found that workers in greater deductible strategies ended up a lot more likely to report problems paying healthcare bills and skipping or delaying treatment due to price when compared to all those with decrease deductibles. See this KFF/LA Periods Survey Of Grown ups With Employer-Sponsored Coverage for a extra in depth glance.

Prescription Drug Expenses

For a lot of U.S. grownups, prescription drugs are a further element of their regimen care. Between those at present getting prescription drugs, 1 in four say they have difficulty affording their expense, which include at the very least just one third (33%) who acquire 4 or a lot more prescription medicines, these in households with once-a-year incomes underneath $40,000 (32%) and Hispanic grown ups (40%).

The high price tag of prescription medication also prospects some individuals to slash back again on their prescription drugs in several means. About 3 in 10 (29%) U.S. adults say they have not taken their medicines as recommended at some position in the previous calendar year because of the value. This incorporates about one particular in 5 who say they took an more than-the counter drug as a substitute (22%), one in 6 who report that they haven’t loaded a prescription (16%), and 13% who say they have cut their products in fifty percent or skipped a dose of a recommended medication because of to cost.

Complications Spending Healthcare Expenses, and Their Effects

Wellness treatment charges also influence some American homes right after an person gets treatment. A KFF survey from March 2019 located that about just one-fourth of U.S. grown ups (26%) reported they or a domestic member have had problems paying out healthcare payments in the earlier year, and half of this group stating the expenses experienced a significant impression on their household (48% of those people who had healthcare invoice problems, or 12% of all grownups). The share reporting their residence has experienced difficulties paying professional medical charges has remained continual amongst about 25% and 30% for the previous ten years.

Grown ups in homes with incomes below $40,000, these with no health and fitness insurance coverage protection, and those people in households wherever another person has a serious situation are a lot more most likely than their counterparts to report damaging impacts from their lack of ability to pay back for medical charges. Grownups in households with incomes less than $40,000 are practically 4 situations as probably to report difficulties having to pay health care payments as individuals who have annual incomes of $90,000 or a lot more (38% vs. 10%). Practically 50 % (45%) of uninsured adults ages 18-64 report problems shelling out healthcare payments, and one in 4 (25%) say it has experienced a important influence on them and their families. Amid those below age 65 with wellness insurance policy, 1 in four report difficulties spending healthcare charges, and 12% say it has had a significant influence on their life. In addition, one particular-3rd of grownups in households with a severe medical ailment report troubles spending medical bills, compared to a person in 5 in homes devoid of these kinds of a issue.

In 2019, people who claimed challenges shelling out for healthcare expenditures indicated cutting costs in other parts to pay out for them. Most commonly, 16% of all grownups say they had problems shelling out health-related expenditures that led them to place off vacations or significant house buys (16%) and a identical share noted bill troubles that led them to slash paying out on simple house things (15%). A little bit fewer say they have utilized up all or most of their discounts (12%) because of to health-related payments, taken an added job or worked far more hrs (11%), amplified their credit score card credit card debt (9%), borrowed funds from close friends or family members (8%), or taken money out of lengthy-expression price savings accounts (8%) in purchase to shell out healthcare expenditures.

More Stories

Top 5 Benefits of Seeing a Holistic Chiropractor

A New Smile, A New Life: The World of Dental Implantology

How to Get Rid of Type 1 Diabetes